H E D

G E S T R A T E G I E S

With the introduction

of agriculture options on futures in the 1980's, producers have many hedging strategies at their

disposal. As volatility has increased in recent years in many commodity markets, utilizing options

might be a good

alternative to simply hedging with futures.

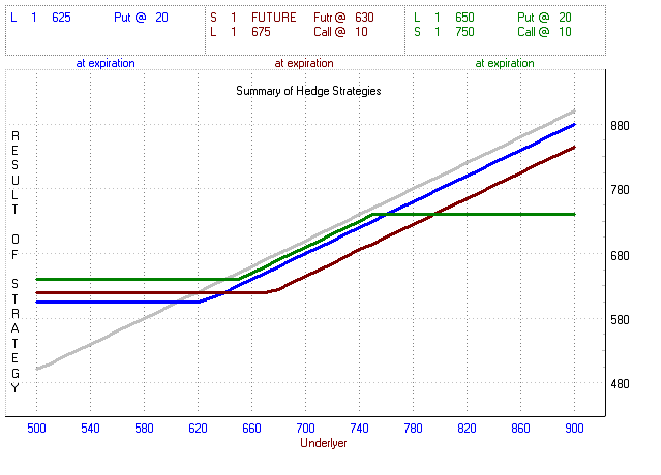

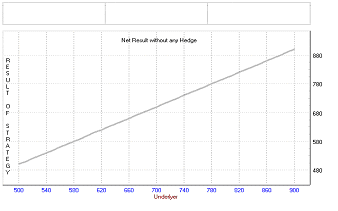

The following charts

display a range of underlying prices from left to right. The effective hedge value at each underlying

price is displayed vertically with the scale at the right side of the chart. No commissions or

fees are included. No basis is

included. Hedges are calculated on a 1:1 ratio. All premium values are calculated at expiration.

For a printer friendly

version,

C L I C K H E R E

NET RESULT WITHOUT

ANY HEDGE

For reference, we have included

this chart to show the result

of not hedging. As the underlying cash price increases in

value, the effective result increases also. Likewise, as the

underlying cash price decreases in value, the effective result

decreases. This line is included in all of the following charts

as a reference against the various strategies.

------------>

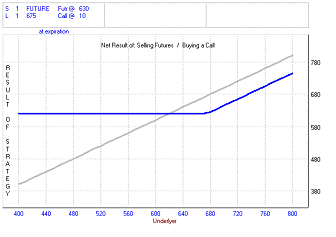

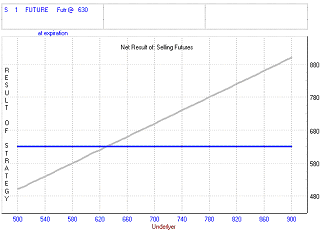

NET RESULT OF SELLING

FUTURES

Selling futures effectively locks

in a price. Whether the

underlying price increases or decreases the result of this

strategy will remain constant. This strategy allows for a

precise hedge and is best suited for less volatile markets.

<------------

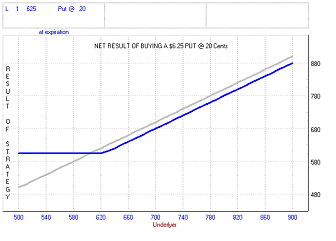

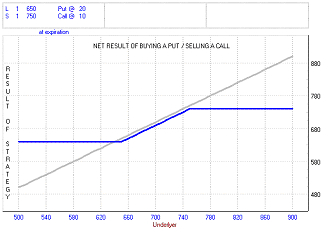

NET RESULT OF BUYING

A PUT

With the purchase of a put, you

get the benefit of downside

protection along with upside potential. As the underlying

cash market increases in price, the loss from the put is

limited to the premium paid. As the market decreases in

price, the value of the put will increase depending on the

selected strike price. This strategy is best suited for more

volatile markets.

------------>