| Kansas City Wheat | Contract Specs |

| Futures | Options | |

| Contract Unit | 5,000 bushels | 5,000 bushels |

| Price Quotation | Cents and quarter cents per bushel | Cents and eighths of a cent per bushel |

| Trading Hours Globex | Sunday - Friday 7:00 pm - 7:45 am CT Monday - Friday 8:30 am - 1:20 pm CT | Sunday - Friday 7:00 pm - 7:45 am CT Monday - Friday 8:30 am - 1:20 pm CT |

| Trading Hours Open Outcry | n/a | Monday - Friday 8:30 am - 1:15 pm CT with post session until 1:20 pm CT immediately following the close |

| Min Price Fluctuation | 1/4 of one cent per bushel $ 12.50 per contract | 1/8 of one cent per bushel $ 6.25 per contract |

| Symbol | KE | KE |

| Contract Months | March ( H) May ( K ) July ( N ) September ( U ) December ( Z ) | March ( H) May ( K ) July ( N ) September ( U ) December ( Z ) |

| Settle Method | Deliverable | Financially |

| Last Trading Day | The business day prior to the 15th calendar day of the contract month. | Ordinary cycle months - The last Friday which precedes by at least two (2) business days the first notice day for Hard Red Winter Wheat Futures. Serial months - The last Friday which precedes by at least two (2) business days the last business day of the calendar month immediately preceding the option serial month |

| TAS | Trading at settlement is available for first 3 listed futures contracts, nearby new- crop July contract (if not part of the first 3 outrights), first to second month calendar spread, second to third month calendar spread, and nearest Jul-Dec OR Dec-Jul spread when available (when December is listed); and are subject to the existing TAS rules. The Last Trade Date for CBOT Grain and Oilseed TAS products will be the First Position Day (FPD) of the front-month contract. FPD is the second to last business day in the month prior to the nearby Trading in all CBOT Grain TAS products will be 19:00-07:45 and 08:30-13:15 Chicago time. All resting TAS orders at 07:45 will remain in the book for the 08:30 opening, unless cancelled. TAS products will trade a total of four ticks above and below the settlement price in ticks of the corresponding futures contract (0.0025), off of a "Base Price" of 0 to create a differential (plus or minus 4 ticks) versus settlement in the underlying product on a 1 to 1 basis. A trade done at the Base Price of 0 will correspond to a "traditional" TAS trade which will clear exactly at the final settlement price of the day. | |

| Settlement Procedure | | |

| Exchange Rulebook | | |

| Price Limit | | |

| Grade & Quality | No. 2 at contract price with a maximum of 10 IDK per 100 grams; No. 1 at a 1 1/2-cent premium. Deliverable grades of HRW shall contain at minimum 11% protein level. However, protein levels of less than 11%, but equal to or greater than 10.5% are deliverable at a ten cent discount to a contract price. Protein levels of less than 10.5% are not deliverable. When warehouse receipts are surrendered to the issuer for load-out, the taker of delivery shall have the option to, at the takers expense, request in the written load-out instructions that the wheat contain no more than 2ppm of deoxynivalenol (vomitoxin). A determination of the level of vomitoxin shall be made at the point of origin by the Federal Grain Inspection Service or such other third party inspection service mutually agreeable to the maker and taker of deilvery. A determination of the level of vomitoxin shall be based on the average test results of the wheat loaded in a single day from a single warehouse for each taker of delivery. | Same |

| |

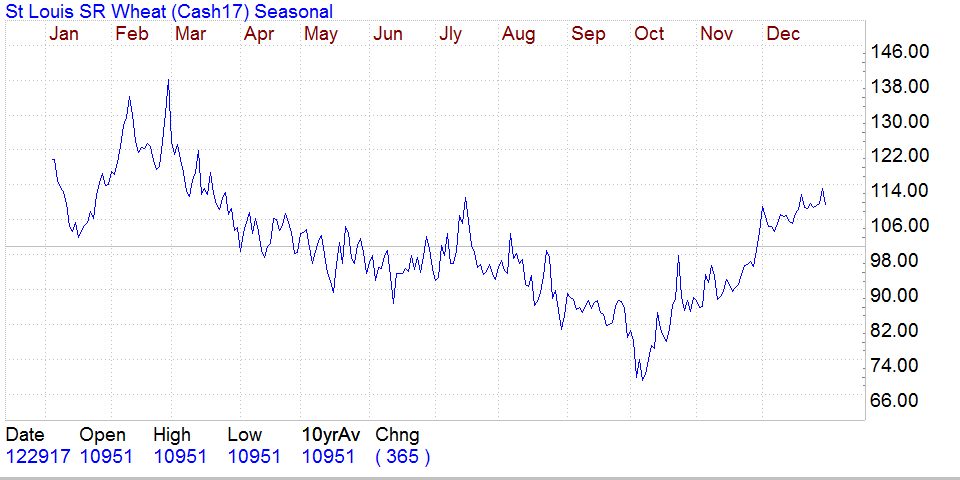

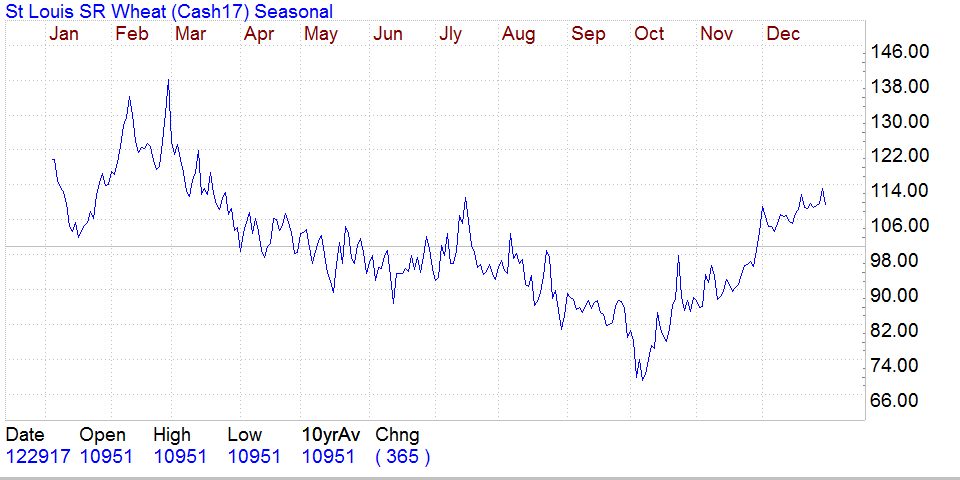

| Seasonal ( KC Wheat ) |

| DISCLAIMER: This information is not to be construed as an offer to sell or a solicitation or an offer to buy the commodities herein named. The factual information of this report has been obtained from sources believed to be reliable, but is not necessarily all-inclusive and is not guaranteed as to the accuracy, and is not to be construed as representation by our firm. The risk of loss when trading futures and options is substantial. Each investor must consider whether this is a suitable investment. Past performance isnot indicative of future results. |