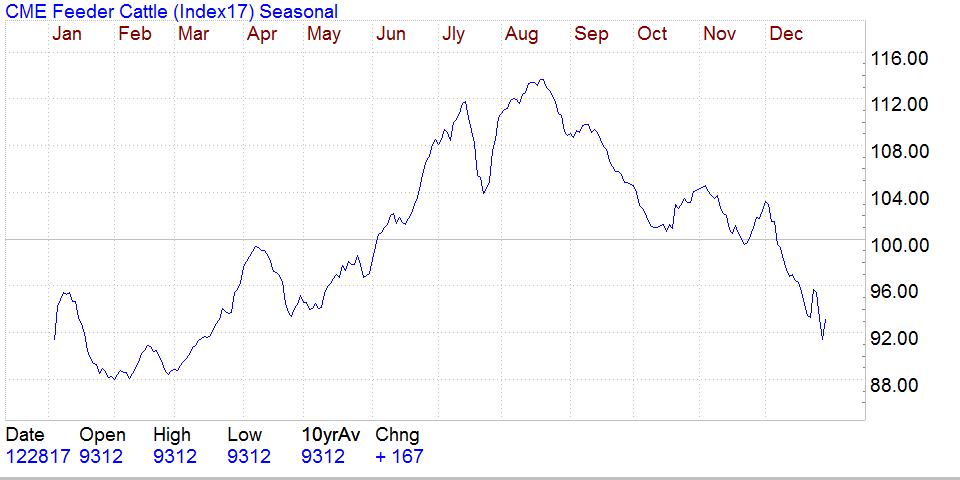

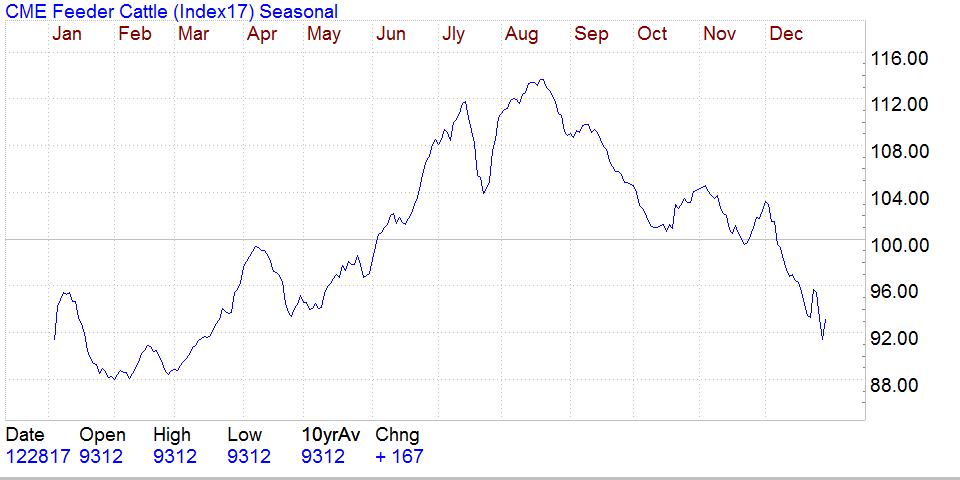

USDA 7-Day Feeder Index ( 10 Year Seasonal )

| Feeder Cattle | Contract Specs |

| Futures | Options | |

| Contract Unit | 50,000 lbs | 50,000 lbs |

| Price Quotation | Cents per pound | Cents per pound |

| Trading Hours Globex | Monday-Friday: 8:30am - 1:05 pm CT | Monday-Friday: 8:30am-1:05 pm CT |

| Trading Hours Open Outcry | N/A | Monday-Friday: 8:30am-1:02pm CT |

| Min Price Fluctuation | $.00025 per pound (=$12.50 per contract) | $.00025 per pound (=$10 per contract) |

| Symbol | FC | FC |

| Contract Months | January ( F ) March ( H ) April ( J ) May ( K ) August ( Q ) September ( U ) October ( V ) November ( X ) | January ( F ) March ( H ) April ( J ) May ( K ) August ( Q ) September ( U ) October ( V ) November ( X ) |

| Settle Method | Financially Settled | Deliverable |

| Last Trading Day | Last Thursday of the contract month with exceptions for November and other months, 12:00 p.m. | Last Thursday of the contract month with exceptions for November and other months, 12:00 p.m. |

| TAS | Settlement (TAS) Trading at settlement is available for first 2 listed futures contract months, a calendar spread between the first and second cotnract month, and are subject to the existing TAS rules. The Last Trade Date for CME Livestock TAS products will be the second to last business day in the month prior ro the named contract month. Trading in all CME Livestock TAS products will be 8:30 am-1:00 pm Chicago time Monday-Friday. TAS products will trade a total of four ticks above and below the settlement price in ticks of the corresponding futures contract (0.00025), off of a "Base Price" of 0 to create a differential (plus or minus 4 ticks) versus settlement in the underlying product on a 1 to 1 basis. A trade done at the Base Price of 0 will correspond to a "traditional" TAS trade which will clear exactly at the final settlement price of the day. | |

| Settlement Procedure | | |

| Exchange Rulebook | | |

| Price Limit | $.045/pound = $2,250 | $.045/pound = $2,250 |

| Grade & Quality | | |

| |

| USDA 7-Day Feeder Index ( 10 Year Seasonal ) |

|

| DISCLAIMER: This information is not to be construed as an offer to sell or a solicitation or an offer to buy the commodities herein named. The factual information of this report has been obtained from sources believed to be reliable, but is not necessarily all-inclusive and is not guaranteed as to the accuracy, and is not to be construed as representation by our firm. The risk of loss when trading futures and options is substantial. Each investor must consider whether this is a suitable investment. Past performance isnot indicative of future results. |