| Soybean Meal | Contract Specs |

| Futures | Options | |

| Contract Unit | 100 Short Tons (~91 metric tons) | One Soybean Meal futures contract (of a specific month) of 100 short tons |

| Price Quotation | Dollars and Cents per short ton | Dollars and Cents per short ton |

| Trading Hours Globex | Sunday - Friday 7:00 pm - 7:45 am CT Monday - Friday 8:30 am - 1:20 pm CT | Sunday - Friday 7:00 pm - 7:45 am CT Monday - Friday 8:30 am - 1:20 pm CT |

| Trading Hours Open Outcry | n/a | Monday - Friday 8:30 am - 1:15 pm CT with post session until 1:20 pm CT immediately following the close |

| Min Price Fluctuation | 10 cents per short ton ($10 per contract) | 1/8 of one cent per bushel $ 6.25 per contract |

| Symbol | SM | SM |

| Contract Months | January ( F ) March ( H) May ( K ) July ( N ) August ( Q ) September ( U ) October ( V ) December ( Z ) | January ( F ) March ( H) May ( K ) July ( N ) August ( Q ) September ( U ) October ( V ) December ( Z ) |

| Settle Method | Deliverable | |

| Last Trading Day | The business day prior to the 15th calendar day of the contract month. | Unexercised Soybean Meal futures options shall expire at 7:00 p.m. on the last day of trading |

| TAS | Trading at settlement is available for First 3 listed futures contracts; nearby new-crop December contract (if not part of the first 3 outrights); first to second month calendar spread; second to third month calendar spread; nearest Jul-Dec spread when available (when July is listed), and are subject to the existing TAS rules. The Last Trade Date for CBOT Grain and Oilseed TAS products will be the First Position Day (FPD) of the front-month contract (FPD is the second to last business day in the month prior to the nearby contract month). Trading in all CBOT Grain TAS products will be 19:00-07:45 and 08:30-13:15 Chicago time. All resting TAS orders at 07:45 will remain in the book for the 08:30 opening, unless cancelled. TAS products will trade a total of four ticks above and below the settlement price in ticks of the corresponding futures contract (0.10), off of a "Base Price" of 0 to create a differential (plus or minus 4 ticks) versus settlement in the underlying product on a 1 to 1 basis. A trade done at Base Price of 0 will correspond to a "traditional" TAS trade which will clear exactly at the final settlement price of the day. | |

| Settlement Procedure | | |

| Exchange Rulebook | | |

| Price Limit | | |

| Grade & Quality | Through December 2018, 48% Protein Soybean Meal, meeting the requirements listed in the CBOT Rules and Regulations. As of January 2019, 47.5% Protein Soybean Meal, meeting the requirements listed in the CBOT Rules and Regulations. | Same |

| |

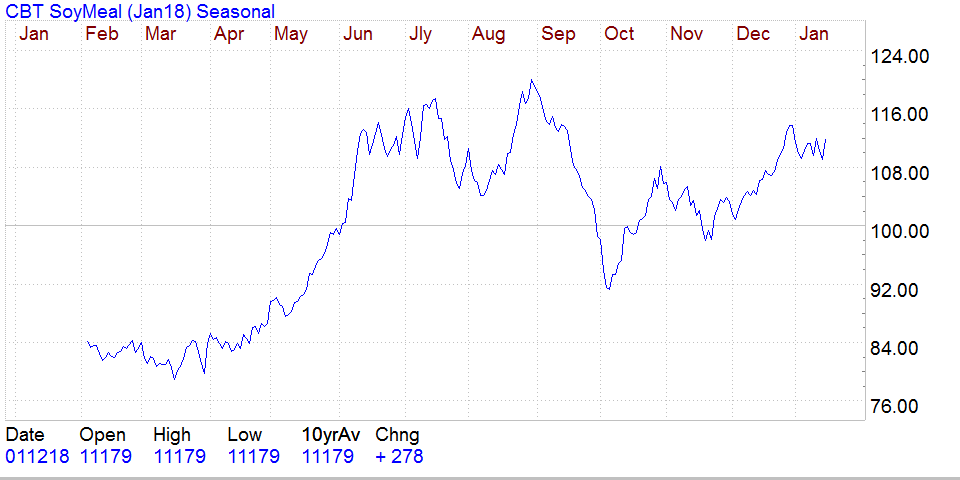

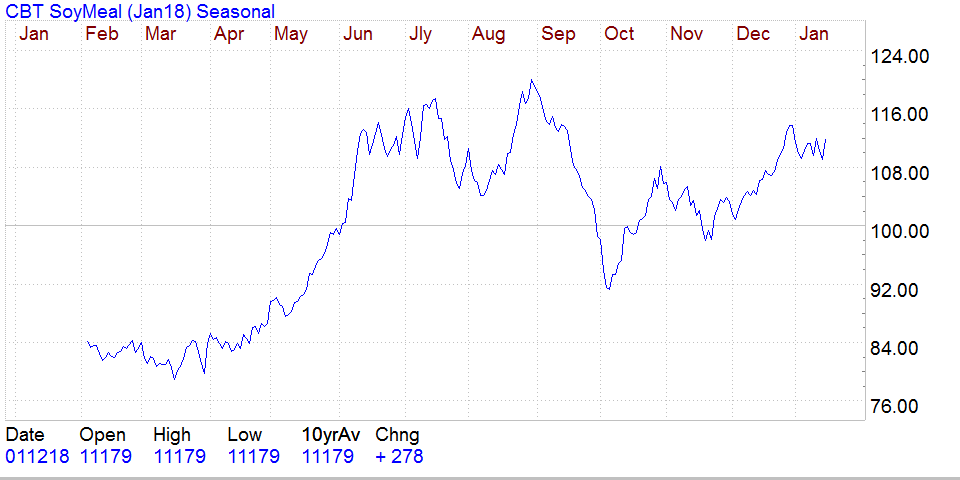

| Seasonal Soybean Meal |

| DISCLAIMER: This information is not to be construed as an offer to sell or a solicitation or an offer to buy the commodities herein named. The factual information of this report has been obtained from sources believed to be reliable, but is not necessarily all-inclusive and is not guaranteed as to the accuracy, and is not to be construed as representation by our firm. The risk of loss when trading futures and options is substantial. Each investor must consider whether this is a suitable investment. Past performance isnot indicative of future results. |