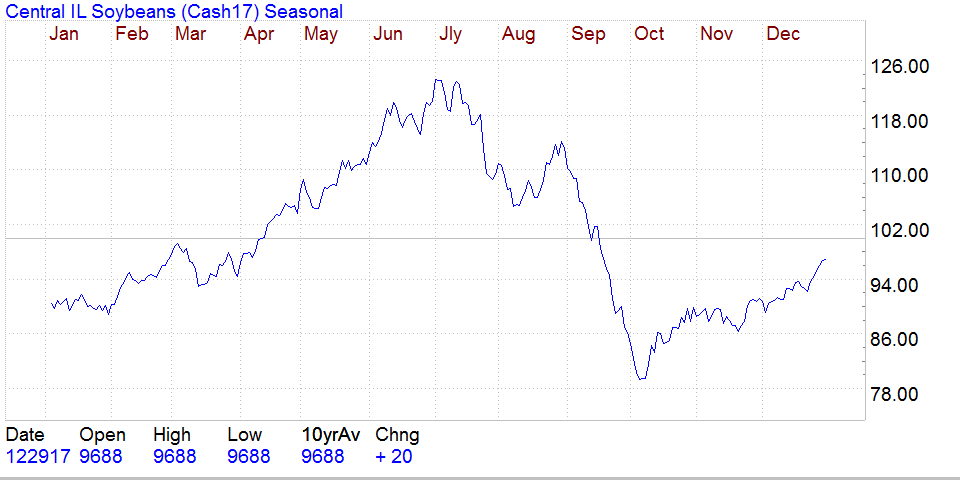

Seasonal ( Central Illinois Soybeans)

| Soybeans | Contract Specs |

| Futures | Options | |

| Contract Unit | 5,000 bushels ( ~ 136 Metric Tons ) | 5,000 bushels ( ~136 Metric Tons ) |

| Price Quotation | Cents per bushel | Cents per bushel |

| Trading Hours Globex | Sunday - Friday 7:00 pm - 7:45 am CT Monday - Friday 8:30 am - 1:20 pm CT | Sunday - Friday 7:00 pm - 7:45 am CT Monday - Friday 8:30 am - 1:20 pm CT |

| Trading Hours Open Outcry | n/a | Monday - Friday 8:30 am - 1:15 pm CT with post session until 1:20 pm CT immediately following the close |

| Min Price Fluctuation | 1/4 of one cent per bushel $ 12.50 per contract | 1/8 of one cent per bushel $ 6.25 per contract |

| Symbol | S | S |

| Contract Months | January ( F ) March ( H ) May ( K ) July ( N ) August ( Q ) September ( U ) November ( X ) | January ( F ) March ( H ) May ( K ) July ( N ) August ( Q ) September ( U ) November ( X ) |

| Settle Method | Deliverable | Financially |

| Last Trading Day | The business day prior to the 15th calendar day of the contract month. | Unexercised Soybean Futures options shall expire at 7:00pm on the last day of trading. |

| Settlement Procedure | | n/a |

| Exchange Rulebook | | |

| Price Limit | | |

| Grade & Quality | #2 Yellow at contract price, #1 Yelow at a 6 cent/bushel premium, #3 Yellow at a 6 cent/bushel discount | |

| |

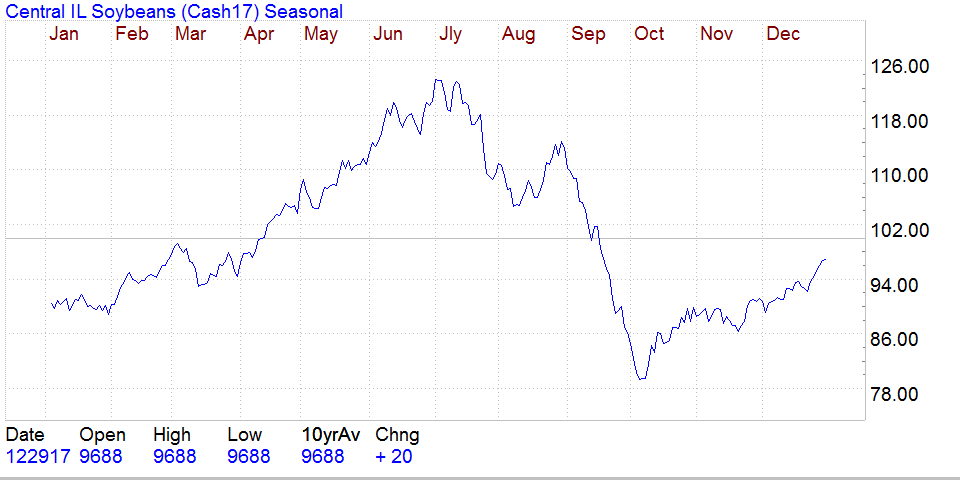

| Seasonal ( Central Illinois Soybeans) |

|

| DISCLAIMER: This information is not to be construed as an offer to sell or a solicitation or an offer to buy the commodities herein named. The factual information of this report has been obtained from sources believed to be reliable, but is not necessarily all-inclusive and is not guaranteed as to the accuracy, and is not to be construed as representation by our firm. The risk of loss when trading futures and options is substantial. Each investor must consider whether this is a suitable investment. Past performance isnot indicative of future results. |